“Understanding and maximising Customer Lifetime Value (CLV) is not just about boosting profits; it’s about developing a culture of customer-centricity”

Customer Lifetime Value (CLV) has quickly become an indicator for sustainable business success and found its way into many business strategies. Instead of looking at the traditional revenue, CLV looks more at customer relationships and their value, offering businesses important insights into their long-term profitability and growth potential. Moreover, it allows for a more granular look at your profitability, because you can analyse the CLV of each group or cohort of your customers depending on what is customer characteristics are most important for your business.

What is Customer Lifetime Value (CLV/LTV)?

CLV is defined as the total profit generated by a customer over their ‘lifetime’ with the business. The higher the CLV , the more valuable the customer is to the business. Unlike short-term metrics such as one-time purchases or monthly revenue, CLV takes into account the long-term impact of customer interactions. Moreover, it also shows the expected amount of time your customer will be loyal to your business.

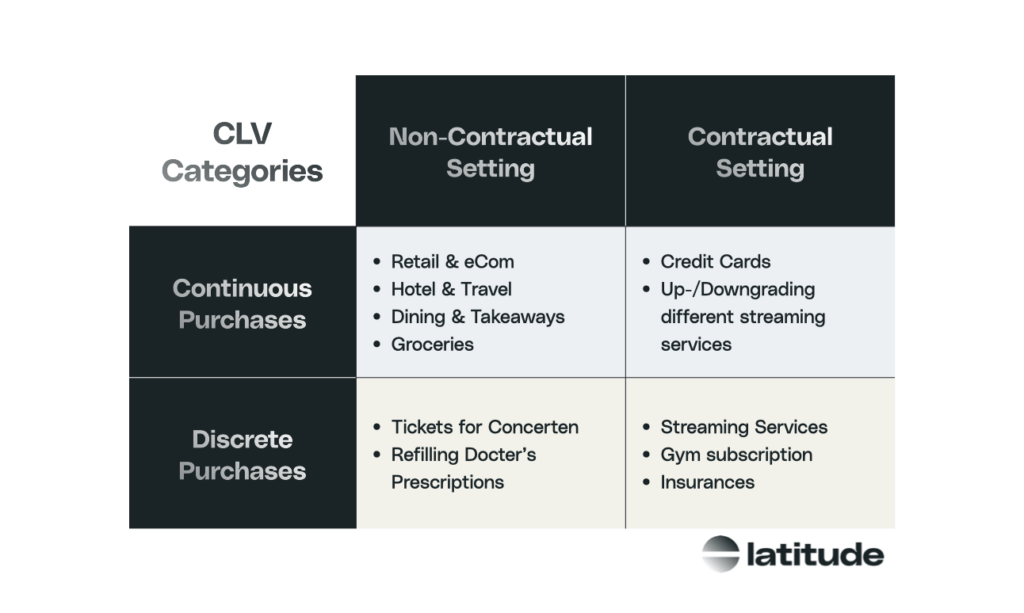

For the calculation of CLV, a combination of historical data and predictive modelling are necessary. There is a categorisation based on the type of business you are in and the type of purchases your customers can make. The main difference relevant for this introduction is the difference between being in a Contractual vs. Non-Contractual setting. We will give an introduction to both.

No matter what category you fall into, there are three main factors that need to be considered when calculating CLV. These factors are the Purchase frequency and value, the churn rate of your customers and the costs that is associated with each of your customers. Let’s quickly dive into each of them:

Purchase Frequency & Value

How often does a customer come back to make a purchase and how much revenue do they generate each time? The prediction for these values depends on the business model of the company. Companies with a contractual business model, such as paid memberships or contracts, know exactly when and what a customer will pay each cycle. So both the historical as the predictive value are known. However, it becomes more complex when talking about non-contractual settings as purchases can happen at any time with an unknown value (retail & e-commerce for example). For these settings the historical purchase pattern of the customer has to be used to try to predict the time and value of their future purchases.

Churn Rate

How is the ‘end’ of the lifetime of a customer defined and when will this ‘end’ be for a customer? Again, this depends on the business model of the company. For the contractual setting, the definition is clear: the moment the contract or membership is terminated. The when is a different story, for which assumptions based on the historical purchases are needed to set up a prediction for future customer churn. The non-contractual definition of churn is not as easily defined and depends on the business model and the kind of product it offers. Did someone churn after not buying anything for 6 months? Or do they only buy in one season a year, which would mean that the time until you define a churn should be after least a year. Or is the given product a one-time buy which only needs replacement after a few years, how is churn defined then? After setting the definition a predictive modelling approach has to be used to forecast future customer churn.

Costs

What kind of costs are associated to the purchases of the customer? This will be the final piece of the puzzle which will show if a customer is even profitable at all. How do the cost of acquiring a customer or shipping out an order compare to the revenue that the respective customer generates?

Stay tuned for another blog with more technical details on how to predict CLV in a non-contractual business setting

Why is Customer Lifetime Value important?

Understanding and maximising Customer Lifetime Value (CLV) is not just about boosting profits; it’s about fostering a culture of customer-centricity. By prioritising CLV, businesses can shift their focus from short-term gains to nurturing long-lasting relationships with customers, thereby laying the foundation for sustainable growth and competitive advantage.

Moreover, it connects four essential pillars of any business strategy together:

- Long-term profitability

Improving on the CLV metric now can increase the overall revenue in the future. By identifying the high-value customers and focusing on keeping them happy and retain them, the long-term effects will be optimal. - Customer Retention

CLV highlights the importance of customer retention by illustrating the potential revenue loss associated with customer churn. By implementing strategies to improve customer retention and reduce churn rates, businesses can increase CLV and drive sustainable growth. - Customer Relationships

By tracking CLV, you can identify issues within the business that stand in the way of long-lasting relationships with customers. That way the business can adjust the products, services and marketing efforts to meet the needs of the customer. - Marketing & Growth

Targeting the right customers, the most profitable ones, will make for a more optimal allocation of the marketing budget and will make sure that the costs are earned back.

Conclusion

In conclusion, Customer Lifetime Value (CLV) is not just a metric; it’s a strategic lens through which businesses can view and enhance their long-term growth and profitability. By focusing on CLV, companies emphasise the importance of building strong, lasting relationships with their customers, which in turn drives customer retention, long-term profitability, and sustainable competitive advantage. Understanding and maximising CLV is essential for developing a customer-centric culture that not only boosts profits but also fosters loyalty and enhances the overall customer experience.

Here at Latitude, our employees have gained experience in implementing Customer Lifetime Value models and leveraging its insights at many leading organisations. Curious about the possibilities? Make sure to reach out!